foreign gift tax return

Check the box if you are married and filing a current year joint income tax return and you are filing a joint Form 3520 with your spouse. Form 3520 is an informational return similar to a W-2 or 1099 form rather than an actual tax return because foreign gifts themselves are not subject to income tax unless they produce income.

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

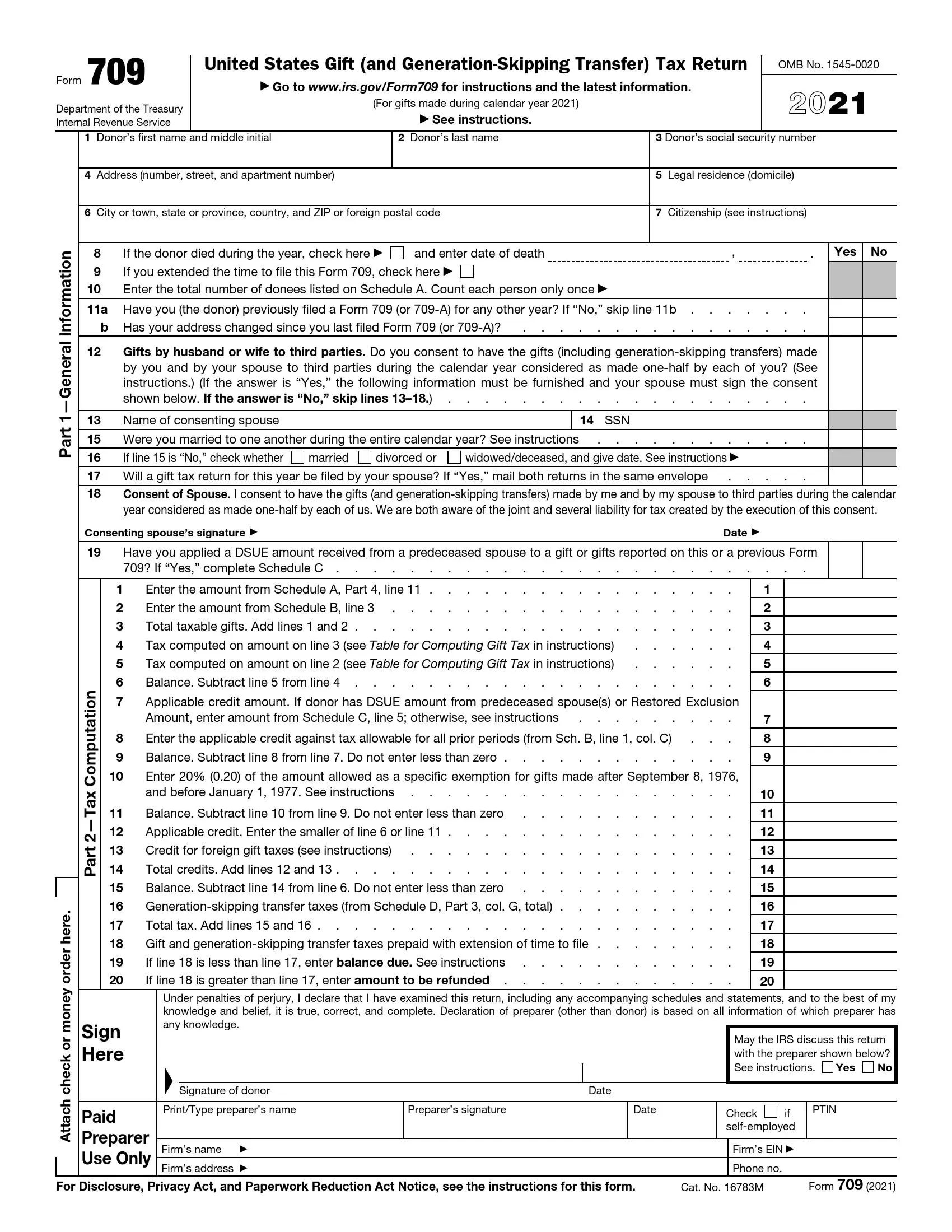

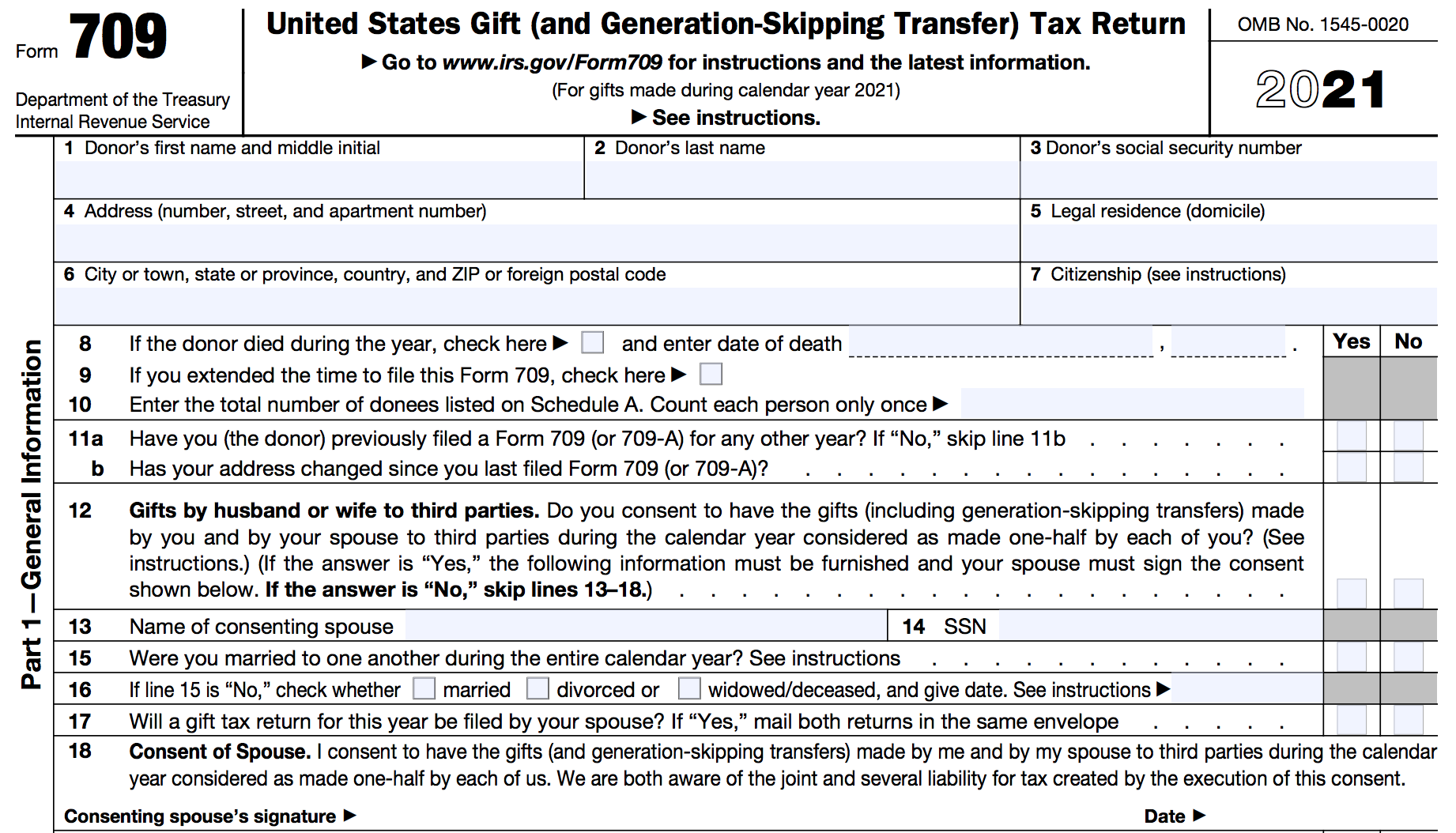

Form 709 United States Gift And Generation Skipping Transfer Tax Return

IRS Form 3520 Annual Report to Report Transactions With Foreign Trusts and Receipts of Foreign Gifts is one of the most common reports required when a US.

. If you fail to meet the deadline or fill out the form entirely you could be charged 35 of your foreign inheritance or gift as a penalty fee. If the value of those gifts to any one person exceeds 15000 you need to file a Gift Tax Return. The IRS Form Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts in accordance with Internal Revenue Code Section 6039F is a deceptive international information reporting form.

For a nonresident not a citizen of the United States the gift tax applies to the transfer by gift of certain US-situated property. The IRS will provide a copy of a gift tax return or the gift tax return transcript when Form 4506 or Form 4506-T is properly completed and submitted with substantiation and payment. You must individually identify each gift and the identity of the donor.

Persons who must file this form. In addition gifts from foreign corporations or. For example an American expat receives a gift in the amount of 90000 from a foreign person.

Person must report the gift when the threshold is met on IRS form 3520. Ownership of foreign trusts under the rules of sections Internal Revenue Code 671 through 679. Certain transactions with foreign trusts.

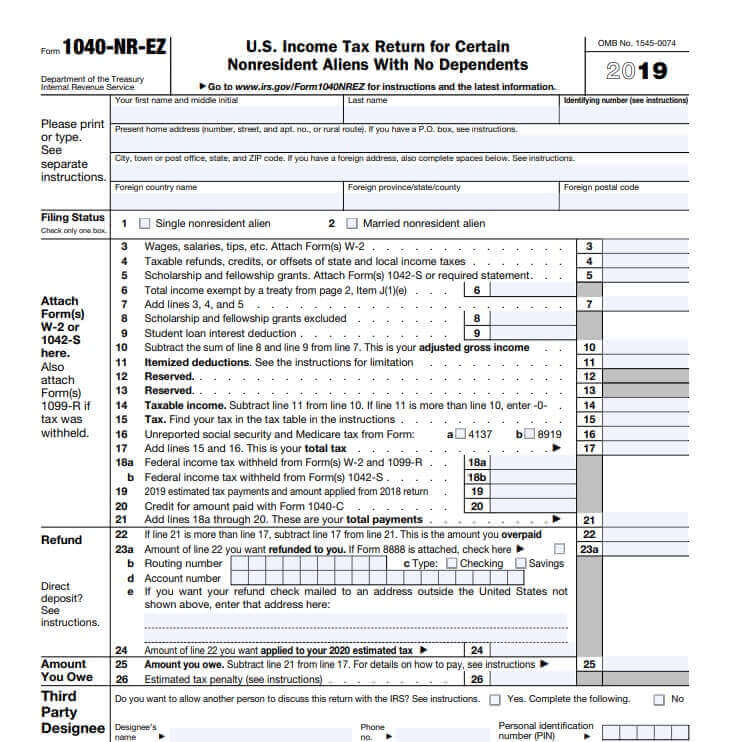

Upon receipt and verification including matching current taxpayer and taxpayer representative records a copy of the original tax return or the account transcript will be mailed. Recipients of foreign gifts. According to the IRS if you are a nonresident alien who made a gift subject to the foreign gift tax you must file a gift tax return Form 709 if.

A common question our Tax Advisors get is How much money can you receive as a gift from overseas. You gave any gifts of future interests Your gifts of present interests to any donee other than your spouse total more than 13000 or Your outright. And check box 1i.

Form 3520 is an informational return in which US. File Form 3520 separately from your income tax return. You would therefore file it separately from your Form 1040 tax return.

Persons tax return check this box and attach statement. The tax applies whether or not the donor intends the transfer to be a gift. As a result the person giving the gift files a gift tax return.

File Form 3520 each year you receive a foreign gift separately from your income tax return by following the directions in the Instructions to Form 3520. There are no specific IRS taxes on gifts received from a foreign person. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Person receives a gift from a foreign person that meets the threshold for filing the US. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return. Person to file a Form 3520 to report the gift.

In other words if a US. If you are the sole beneficiary then you file the 3520 in your name only. Who Reports Gifts from Foreign Persons to the IRS.

In this scenario there are no US expat gifts tax reporting requirements in regards to this gift. If both you and your spouse are beneficiaries of the gift then you both should file a joint form 3520. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

American expatriates are subject to gifts tax reporting requirements on US expat tax returns if the aggregate value of foreign gifts exceeds 100000. For gifts from foreign corporations or foreign partnerships you are required to report the gifts if the gifts from all entities collectively exceed 16388 for 2019. Form 3520 for US.

100s of Top Rated Local Professionals Waiting to Help You Today. While the form itself is not as complicated as other forms such as Form 5471 the penalties for non-compliance are simply outlandish. This value is adjusted annually for inflation.

Important Practice Tip If you receive a gift from Taiwan for Example of 600000 and your Dad needed 12 of their friends to each facilitate the transfer of 50000 due to currency restrictions this is still reportable. Therefore the IRS requires the recipient US. Person receives a gift from a foreigner.

Why isnt the Gift Taxable. When Do You Need to File a Form 3520. It doesnt matter if the gift is to a US.

The receipt of cash as a gift or inheritance is not taxable. About Form 3520 Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. If you inherited land worth 100000 or more from a foreign person you have to report it by filing Form 3520.

Here are a few tax Form 709 examples. Citizen is moving from Illinois to London for a new job. If you are a US.

Person other than an organization described in section 501c and exempt from tax under section 501a who received large gifts or bequests from a foreign person you may need to complete Part IV of Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of. The purpose of Form 3520 is to be an informational return that is included with your personal income tax return. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts.

Form 3520 is not a Tax Form. Taxpayers report transactions with certain foreign trusts ownership of foreign trusts and receipts of large gifts from foreign entities. If an extension was requested for the tax return check this box.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. If an automatic 2-month extension applies for the US. Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who received large gifts or bequests from a foreign person you may need to complete Part IV of Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts and file the form by the.

You are able to file a joint form with your spouse if applicable. Person receives from that nonresident alien individual or foreign estate during the taxable year exceeds 100000 then the US. Inheritance taxes are only deductible on an estate tax return so that would not apply.

Further you must report foreign gifts from foreign corporations or foreign partnerships of more than 16649 as of tax year 2020 on Form 3520. So it is very important. Form 3520 is due the fourth month following the end of the persons tax year typically April 15.

The IRS states in the opening paragraph in this publication that if you are a US. Has no taxing authority over foreign persons. In this case you write both names in box 1a your TIN in box 1b and your spouses TIN in box 1d.

Person or a foreign person or if the giftproperty is in the US. Person must r eport the Gift on Form 3520. Person received from that nonresident alien.

You have to report the sale of the land in the. Person has to report the foreign gift. Person must separately report each gift exceeding 5000 that the US.

Persons and executors of estates of US. The receipt of the land is not taxable. Decedents file Form 3520 to report.

Person receives a gift from a foreign person that specific transaction is not taxable. For gifting purposes there are three key categories of US. If the donor of the gifts is a nonresident alien individual or foreign estate and the aggregate value of the gifts that the US.

Irs Form 709 Fill Out Printable Pdf Forms Online

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

How To Fill Out A Fafsa Without A Tax Return H R Block

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Gifts From Foreign Persons New Irs Requirements 2022

Complying With New Schedules K 2 And K 3

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

6 Surprising Facts Found In Presidential Tax Returns Through History History

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

What Are The Tax Consequences Of Giving A Gift To A Foreign Person Epgd Business Law

Gifting Money To Family Members Everything You Need To Know

Tax Cuts The Gift That Keeps Not Giving

Us Tax For Nonresidents Explained What You Need To Know

Gifts From Foreign Persons New Irs Requirements 2022

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management